Global economic trends and commodity prices have a significant impact on the mining industry. The sector is highly sensitive to fluctuations in demand, supply, and external economic factors such as geopolitical events, technological advancements, and macroeconomic shifts. Here’s how these factors interact with the mining industry:

1. Commodity Prices and Market Demand

- Impact of Price Fluctuations: Mining companies’ profitability directly correlates with the prices of the minerals and metals they extract. When global demand for a particular commodity increases, prices rise, making mining more profitable. Conversely, when demand drops, prices fall, and mines may become less economically viable.

- High Prices: During periods of high commodity prices, mining companies often ramp up production, invest in new projects, and expand exploration activities to capitalize on high margins.

- Low Prices: When prices decline, mining companies may scale back operations, delay investments, and prioritize more cost-effective production. In extreme cases, mines may be shut down temporarily or permanently.

- Example: The iron ore market is heavily influenced by global steel demand. When China’s construction boom was strong in the 2000s and early 2010s, iron ore prices soared, benefiting major producers like Australia and Brazil.

2. Global Economic Growth and Infrastructure Development

- Booming Economies: When global economies are growing—especially in emerging markets like China, India, and Africa—there is increased demand for raw materials like steel, copper, aluminum, and coal, which are essential for infrastructure development (roads, buildings, energy production, etc.). This fuels the mining industry as these countries invest heavily in construction and manufacturing.

- Slowdown or Recession: During periods of economic slowdown or recession, demand for commodities typically decreases, leading to lower prices and reduced output. This is especially true for metals and minerals used in industrial manufacturing and construction.

- Example: The 2008 financial crisis caused a major drop in demand for metals like copper and steel, leading to price declines and cutbacks in mining activities globally.

3. Geopolitical Factors

- Supply Disruptions: Geopolitical instability—such as wars, trade disputes, or sanctions—can disrupt the supply of critical minerals and metals. This may lead to price spikes or supply shortages.

- Example: The Russia-Ukraine conflict (2022) disrupted global supplies of certain minerals like nickel (from Russia) and palladium (a key component in catalytic converters). These disruptions led to higher prices in global markets.

- Trade Tariffs and Restrictions: Tariffs and trade restrictions can impact the flow of raw materials. For example, the US-China trade war (2018–2020) led to tariffs on metals like steel and aluminum, affecting both supply chains and prices.

- Political Risk in Mining Countries: Many mining operations are located in countries with unstable political environments. A shift in government policy, nationalization of resources, or regulatory changes can impact mining operations. Countries like Zimbabwe or Venezuela, with high political instability, can see abrupt changes in mining regulations.

4. Currency Exchange Rates

- Commodity Price in USD: Most global commodity prices are denominated in US dollars. A strong US dollar can make commodities more expensive for buyers using other currencies, potentially reducing demand and affecting mining revenues.

- Currency Depreciation: For countries that mine and export commodities, a weakening local currency can be beneficial as it makes exports cheaper on the international market. This can improve the competitiveness of mining companies based in those countries.

- Example: Australian dollar depreciation has often benefited Australian mining companies, as it lowers the cost of local operations and increases revenue when converting foreign earnings back into AUD.

5. Technological Innovation and Automation

- Mining Efficiency: The adoption of new technologies (e.g., automation, AI, drones, 3D mapping, and data analytics) can help mining companies reduce costs, increase productivity, and optimize resource extraction. This can help mitigate the impact of fluctuating commodity prices by improving operational efficiency.

- Cost Reduction: When commodity prices are low, mining companies often look for ways to cut costs through automation and innovation, ensuring continued profitability. These technologies can also enhance safety and reduce labor costs, which is significant given the labor-intensive nature of mining.

- Example: Major mining companies like Rio Tinto and BHP have invested heavily in autonomous trucks and drilling systems, which have reduced costs and improved production during periods of price volatility.

6. Environmental and Regulatory Changes

- Environmental Regulations: The increasing focus on sustainability and green technologies can impact the mining industry. Stricter environmental laws and regulations, especially in countries like the EU, Canada, and the US, can raise operational costs for mining companies. These laws can restrict certain mining practices, such as open-pit mining or coal extraction, which may require more expensive alternatives.

- Demand for Green Minerals: There is growing demand for minerals that support renewable energy and electric vehicle (EV) production, such as lithium, cobalt, and nickel. This shift can drive increased exploration and mining of these critical minerals as part of the transition to a low-carbon economy.

- Example: The growing global demand for lithium due to its role in electric vehicle batteries has led to increased exploration in places like Chile, Argentina, and Australia, where the lithium triangle is located.

7. Supply Chain Disruptions

- Logistics and Shipping Costs: Mining is a global industry, and the transportation of raw materials is a critical part of the supply chain. Increases in fuel costs, shipping costs, or port congestion can disrupt the delivery of materials and lead to higher prices for end consumers.

- Example: The COVID-19 pandemic caused significant disruptions to global supply chains, including shipping and transportation. This led to delays in the delivery of key minerals and price increases for some commodities.

- Infrastructure Investment: The ability of mining companies to access and transport materials often depends on infrastructure such as roads, rail, and ports. Investment in infrastructure can improve supply chain efficiency, which can help lower costs and improve profit margins.

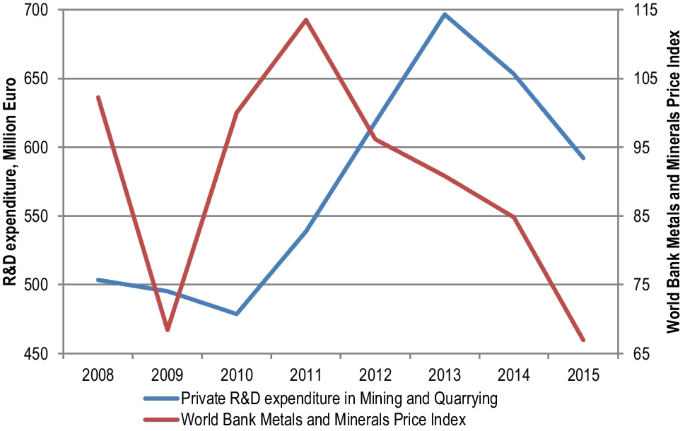

8. Investment and Capital Availability

- Capital Flow: The mining industry requires significant capital investment for exploration, development, and operation of mines. When the global economy is doing well and commodity prices are high, there’s greater access to financing and investment in new mining projects. Conversely, during downturns, investment may decline, leading to fewer new projects and slower exploration.

- Private and Public Investment: Governments may invest in mining ventures, especially in countries rich in natural resources. However, investment trends can also be impacted by global economic uncertainty, interest rates, and access to financial markets.

- Example: High commodity prices often encourage venture capital and private equity firms to fund mining startups or small projects.

9. The Shift to Green and Responsible Mining

- Transition to Green Metals: As the world shifts towards renewable energy and electric vehicles, there is an increasing demand for “green” minerals, such as lithium, cobalt, and copper. These metals are essential for technologies like solar panels, wind turbines, and batteries.

- ESG (Environmental, Social, Governance) Considerations: Investors are increasingly looking at the environmental and social impact of mining projects. Companies that fail to adhere to responsible practices may face investor pushback, legal penalties, or reputational damage. In contrast, companies with strong ESG practices may attract more investment, even in a market downturn.

- Example: The rise of electric vehicles (EVs) has driven demand for metals like lithium, nickel, and cobalt, benefitting mining companies involved in their extraction.

Conclusion

The mining industry is highly sensitive to global economic trends and commodity prices. These factors influence everything from exploration and investment decisions to operational costs and production strategies. Understanding these dynamics is crucial for stakeholders in the mining industry, from companies and investors to governments and local communities.