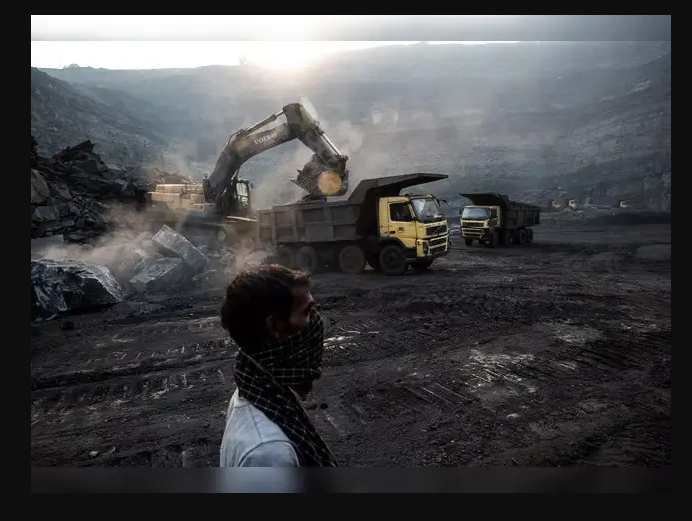

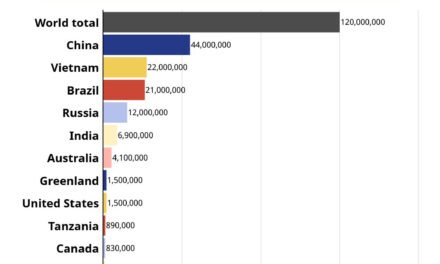

India’s mining sector is confronting a substantial financial challenge following a Supreme Court ruling that permits state governments to retrospectively collect taxes and royalties on mineral-bearing lands from April 1, 2005. This decision could result in arrears totaling approximately ₹1.5 trillion to ₹2 trillion, significantly impacting both public and private mining companies.

Public sector enterprises are expected to bear a considerable portion of this burden, with estimates suggesting arrears between ₹70,000 crore and ₹80,000 crore. For instance, state-owned Steel Authority of India Limited (SAIL) faces an outstanding liability of around ₹3,000 crore. Private sector giants are also affected; Tata Steel has reported a contingent liability of ₹17,347 crore due to this ruling.

To mitigate immediate financial strain, the Supreme Court has allowed these dues to be paid in installments over a 12-year period, commencing on April 1, 2026, without imposing interest or penalties for the period before July 25, 2024. Despite this relief, industry experts express concerns that the substantial financial obligations could deter future investments in the mining sector and potentially lead to increased costs for consumers, particularly in sectors like power generation where costs may be passed down the supply chain.

The Federation of Indian Mineral Industries (FIMI) has highlighted that the Indian mining sector already contends with some of the highest taxation rates globally. The additional retrospective levies are anticipated to further strain the financial health of mining companies, potentially hindering their expansion and modernization efforts. This development underscores the need for a balanced approach that considers both the fiscal autonomy of states and the economic viability of the mining industry.