Supply Chain Disruptions and Geopolitical Tensions

The industry grappled with supply chain disruptions exacerbated by geopolitical tensions. Notably, Greenland’s vast rare earth mineral deposits attracted global interest, with the U.S. and the European Union seeking to reduce reliance on China’s supply dominance. However, mining in Greenland is complicated by low ore concentrations, harsh Arctic conditions, and Greenland’s assertion of control over its future. Significant extraction is estimated to be at least a decade away.

Environmental, Social, and Governance (ESG) Expectations

There was a heightened focus on ESG considerations, with companies under pressure to meet rising environmental and social expectations. This included transitioning towards low-carbon value chains and addressing the environmental footprint of operations.

Technological Advancements

The sector continued to embrace technological advancements, including the integration of artificial intelligence (AI) and machine learning to optimize exploration and extraction processes. These technologies enabled more accurate identification of mineral deposits, improving efficiency and reducing environmental disturbances.

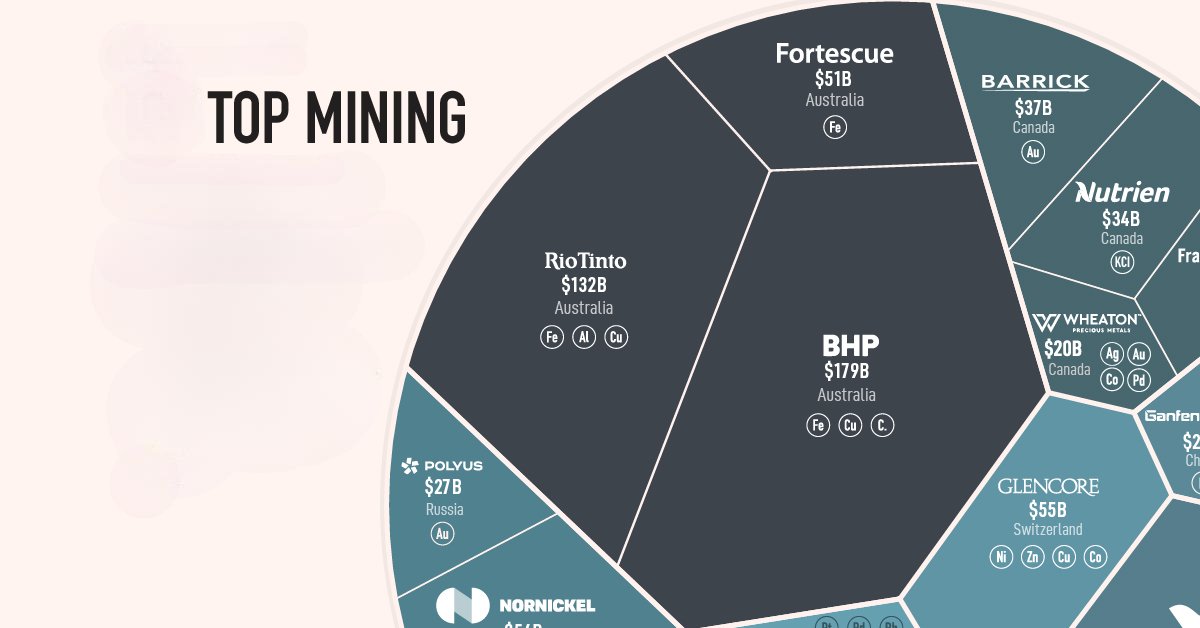

Financial Performance Challenges

The global mining industry faced financial performance challenges, with revenues falling more than 7% due to falling commodity prices and rising costs. This marked the first time since 2016 that industry revenues declined for a second consecutive year.

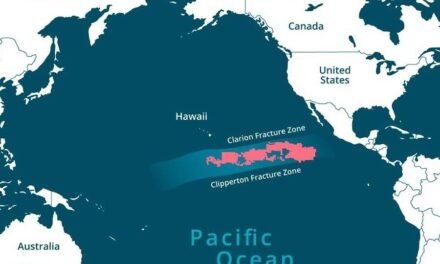

Demand for Critical Minerals

The demand for critical minerals surged, driven by the global shift towards renewable energy and electric vehicles. This trend highlighted the indispensable role of mining and metals in achieving sustainable development goals.

These trends and challenges underscored the mining and metals sector’s need to adapt to evolving market dynamics, technological advancements, and increasing environmental and social expectations.