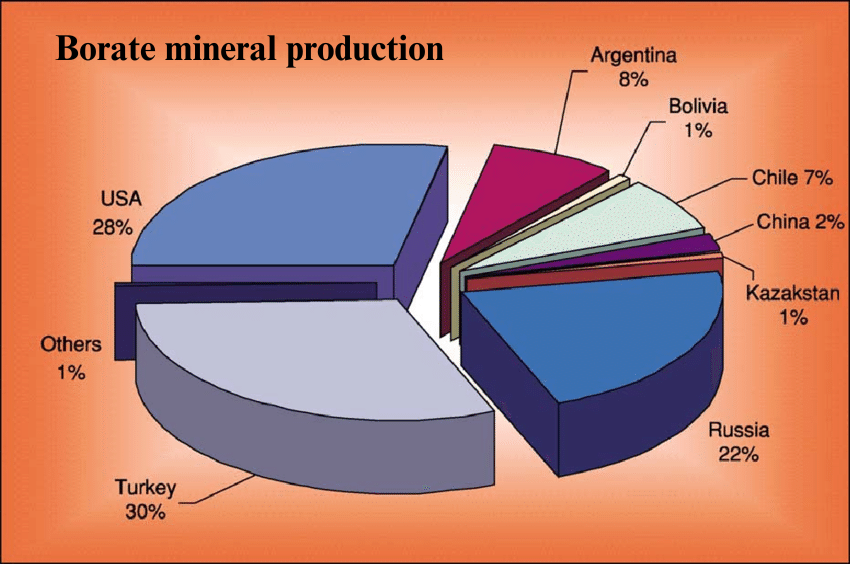

The global borate mineral production is concentrated in a few key countries, which play a crucial role in determining the supply, pricing, and availability of boron-based products used in industries such as glassmaking, agriculture, detergents, and pharmaceuticals. Below is an overview of the leading borate-producing countries, along with an exploration of how the global supply chain influences borate prices and availability.

Leading Borate-Producing Countries

1. Turkey

- Global Share: Turkey is the world’s largest producer of borates, responsible for about 40-50% of global borate production.

- Major Mining Areas:

- Bigadiç and Kırka are two of the largest borate deposits in the country, with reserves of colemanite, ulexite, and borax.

- The Kırka Borate Mining Complex is one of the world’s largest producers of borax and boric acid.

- Export: Turkey is a major exporter of borates to North America, Europe, and Asia. It is home to Eti Maden, a state-owned company that dominates global borate supply.

- Impact on Global Supply: Turkey’s dominance in borate production means that disruptions, such as natural disasters, political instability, or economic shifts in Turkey, can have a significant impact on the global borate market.

2. United States

- Global Share: The U.S. is the second-largest producer, contributing around 25-30% of the world’s borates.

- Major Mining Areas:

- The Mojave Desert in California is home to the Borax mine (operated by Rio Tinto), one of the largest borate operations in the world.

- The Searles Lake in California is another important source, primarily producing borax and boric acid.

- Export: The U.S. is a significant exporter of borate products, with Turkey being one of its primary competitors in the global market.

- Impact on Global Supply: U.S. borate production is essential for industries across North America. However, supply chain disruptions—such as labor strikes or environmental regulations—could affect production, especially in California where borate deposits are concentrated.

3. China

- Global Share: China is a growing player in borate production, accounting for around 10-15% of global supply.

- Major Mining Areas:

- The Qaidam Basin in Qinghai Province is one of China’s major sources of borate minerals, such as borax and ulexite.

- Domestic Consumption: China has a rapidly expanding boron demand driven by its growing electronics, solar, and automotive industries. The country also produces borates for fertilizers and glass manufacturing.

- Impact on Global Supply: China’s focus on domestic consumption for its own high-tech manufacturing and energy sectors could limit the availability of borates for export, impacting international supply chains.

4. Argentina

- Global Share: Argentina produces about 5-10% of the world’s borates.

- Major Mining Areas:

- Famatina Valley is one of the key borate-producing regions, primarily yielding colemanite and borax.

- Argentina’s borate reserves are less extensive compared to Turkey and the U.S., but they remain significant for regional supply.

- Export: Argentina is an important exporter of borates, particularly to Latin America and Europe.

- Impact on Global Supply: Argentina’s relatively smaller share of global borate production means that any disruptions—such as economic downturns or regulatory changes—could have a localized impact on regional supply rather than global supply.

5. Chile

- Global Share: Chile is a smaller player, accounting for around 2-5% of global borate production.

- Major Mining Areas:

- The Atacama Desert is home to significant borate deposits, particularly borax and ulexite.

- Export: Chile exports borates to several countries in North America, Europe, and Asia. However, its production is overshadowed by larger producers like Turkey and the U.S.

- Impact on Global Supply: Chile’s borate production is relatively stable but subject to global commodity price fluctuations, environmental policies, and climate-related challenges.

How the Global Supply Chain Affects Pricing and Availability

The global supply of borate minerals is heavily influenced by the following factors:

1. Production Concentration

- Since a few countries (Turkey, the U.S., and China) dominate borate production, any disruptions in these regions can lead to global price volatility.

- For example, natural disasters, labor strikes, or mining accidents in key production areas can quickly impact global availability, leading to higher prices or supply shortages.

2. Supply and Demand Dynamics

- The demand for borates is closely tied to global industrial growth, especially in sectors such as glassmaking, electronics, renewable energy, and agriculture.

- A boom in electric vehicle production or solar panel manufacturing can increase demand for borates used in glass, fiber optics, and battery technologies.

- If supply from major producing countries is constrained while demand continues to rise, prices for borate minerals and derivatives will likely increase.

3. Export Dependence

- Countries like Turkey and the U.S. rely heavily on exports, and changes in global trade policies—such as tariffs, export bans, or trade agreements—can influence the global borate supply chain.

- For instance, if Turkey imposes export restrictions or China increases its domestic consumption, global borate prices could rise due to reduced availability for international markets.

4. Environmental Regulations

- Environmental concerns—such as water usage in arid regions or the carbon footprint of mining operations—can lead to tighter regulations in major borate-producing countries.

- Stricter mining regulations in California or Turkey could lead to reduced production capacity, thus affecting global supply and pushing prices up.

5. Transportation and Logistics

- Borate minerals are often mined in remote locations, such as the Mojave Desert (U.S.) or the Atacama Desert (Chile). The logistics of transporting these materials to international markets play a role in supply chain costs.

- Fuel prices, shipping delays, or port congestion can add to the cost of borate products, further affecting global prices.

Turkey, the U.S., and China are the leading borate-producing countries, and their share of global supply significantly influences the pricing and availability of boron products.